- +91 9038767365

-

Sobhan Kumar Guha. CWM® QPFP®

AMFI-Registered Mutual Fund Distributor

NISM & CRISIL Certified Wealth Manager

Sobhan Kumar Guha. CWM® QPFP®

AMFI-Registered Mutual Fund Distributor

NISM & CRISIL Certified Wealth Manager

Bonds refer to high-security debt instruments that enable an entity to raise funds and fulfill capital requirements. It is a category of debt that borrowers avail from individual investors for a specified tenure.

Organizations, including companies, governments, municipalities, and other entities, issue bonds for investors in primary markets. The corpus thus collected is used to fund business operations and infrastructural development by companies and governments alike.

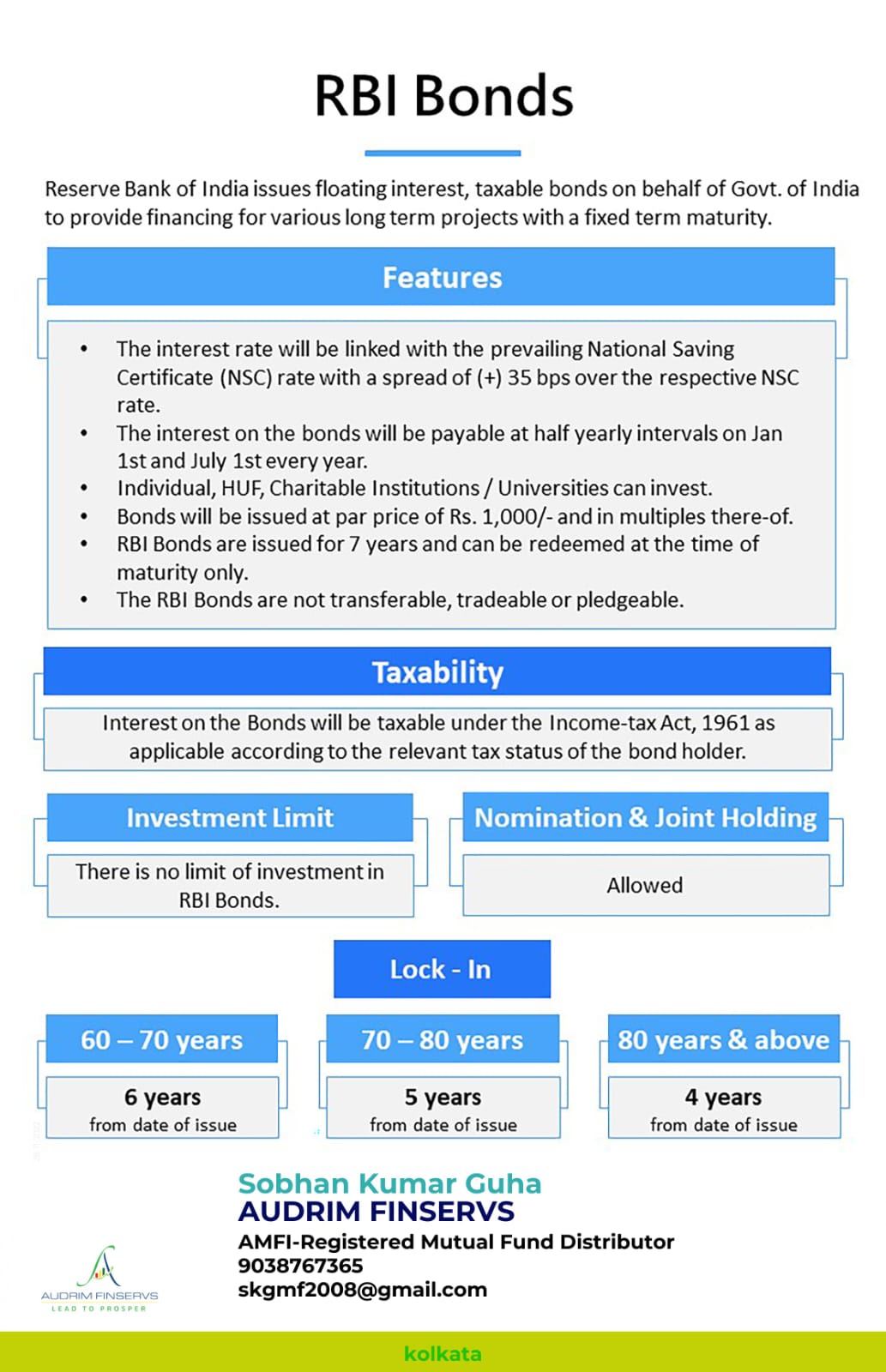

Issued by the Government of India, these floating-rate bonds have a fluctuating interest rate. The Floating Rate Savings Bonds 2020 (Taxable), popularly known as the RBI 7.15% Bonds, currently offer a 7.15% taxable rate of interest over a tenure of seven years. The interest rate on these bonds is reset every six months starting from 1stJanuary or 1st July and is always set at a spread of 35 basis points over the prevailing NSC (National Saving Certificate) rate.

Eligibility: (i) Resident Individual, and (ii) HUF

Entry age: There is no minimum entry age. In the case of minors, the floating rate bonds can be purchased by parents/legal guardians.

Investments: Minimum-Rs 1,000. Maximum-No limit.

Interest: Interest paid at half-yearly intervals on Jan 01 and July 01 every year. There is no option to pay interest on a cumulative basis.

Tenure: Seven years

Account-holding categories: (i) Individual, (ii) Joint, and (iii) Minor through a guardian.

Nomination: Facility is available.

Exit option: There is no exit option from these bonds before maturity, except for senior citizens.

Capital in floating rate bonds is fully protected. However, there is no inflation protection, which means whenever inflation is above the latest interest rate, the deposit earns no real returns. However, when the inflation is below the current interest rate, it does manage a positive real rate of return.

Guarantees : The interest rate on floating-rate bonds is currently 7.15% (subject to semi-annual reset) for a tenure of seven years.

Liquidity : These bonds are not listed and traded and you cannot take loans against them. You are effectively locked in for a tenure of seven years. However, pre-mature encashment is allowed with a penalty for senior citizens after a minimum lock-in period, which varies from four to six years depending on the age bracket in which the senior citizen falls.

For an individual in the age bracket of 60-70 years, the lock-in period is six years. If the investor is in the age bracket of 70-80, it is five years and four years if his age is 80 or more.

Exit option: You can only exit from floating-rate bonds after their maturity at the end of seven years.

Tax implications: The interest on these bonds is fully taxable. There is no deduction on the principal investment.

56/1, B. B. Chatterjee Road,

Kasba, Kolkata - 700042

+91 9830436524

+91 9038767365

Landline No

033 67662816

( 9 AM to 3:30 PM )

Privacy Policy | Disclaimer

Mutual Fund Distributor registered with the Association of Mutual Funds in India (AMFI) holding ARN No. 61008.

AUDRIM Finservs © 2022

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-61008 | Date of initial registration – 26-Apr-2008 | Current validity of ARN – 26-Apr-2028

Important Links | Disclosure | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors